Amid a changing market backdrop where a key channel between public companies and institutional investors has become strained, Rose & Company repurposed and improved upon the institutional equity sales model to enhance our clients' access to the investment community.

A Unique Firm for a Changing Landscape

A fundamental shift has occurred in the capital markets and as a result, the quantity and quality of services traditionally provided to companies by investment banks have both been reduced. The symbiotic relationship between companies and banks has been replaced by one that provides limited benefit to companies. A changing landscape needs a new set of strategies and tactics.

The constant is the need for investor access facilitated by experienced capital markets professionals. Rose & Company has spent the last 5+ years purposefully building a highly accomplished team with the singular goal of acting as our client’s de facto institutional equity sales team. We hold ourselves accountable to a higher standard and serve the interests of our clients only

A snapshot of what we do:

We help companies establish and maintain relationships with high-quality institutional investors

We provide highly informed guidance on how to deliver both mundane and critical messages

We act as trusted advisors to our clients as they develop and execute their strategies

Industry Backdrop

A Fundamental Shift Has Occurred

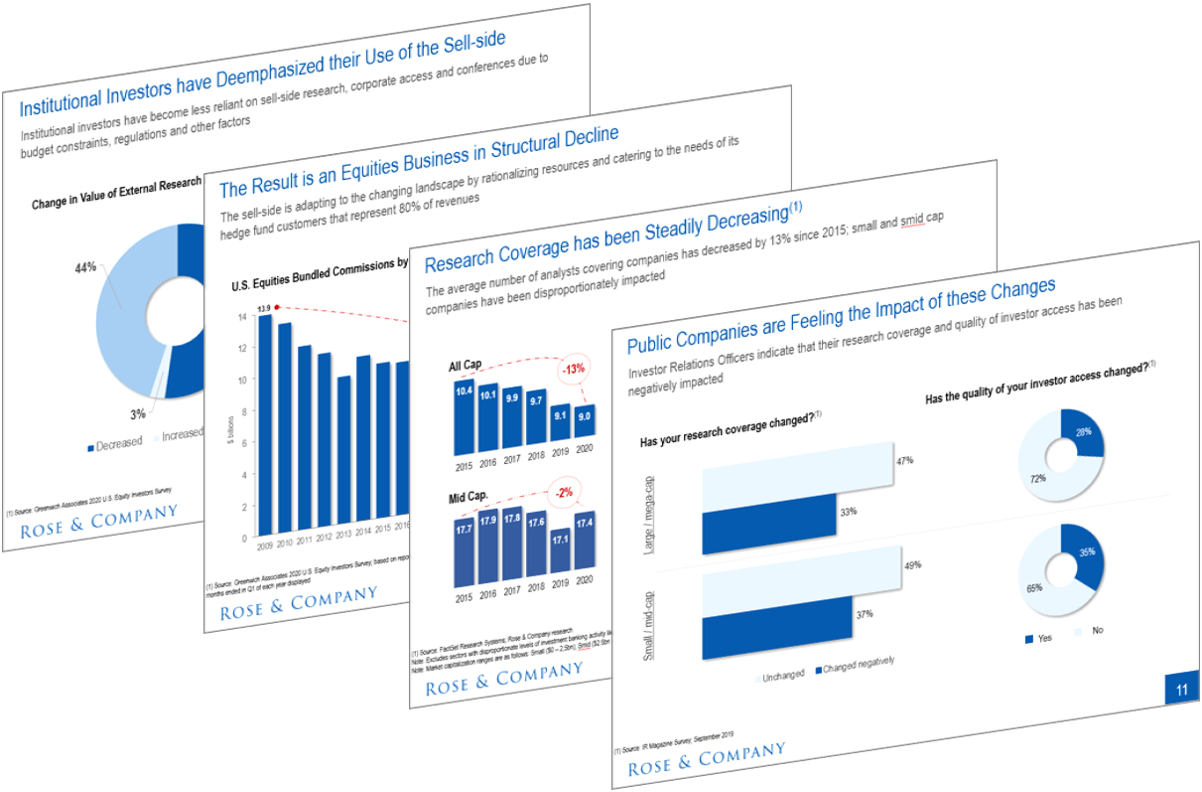

Economic realities have been driving behavioral changes on both the buy-side and the sell-side for years, but this trend has accelerated as U.S. fund managers have reduced their brokerage commission budgets by a stunning 40% from 2016 levels.

Indeed, bundled equity commissions in the U.S. have declined by ~50% in the last decade. Commission dollars allocated to equity research and corporate access have declined by ~55% in the same period. This trend has been catalyzed by MiFID II regulations and buy-side margin compression brought about by the rise in passive investing and no-fee trading.

This has further pressured the global investment banking business, with revenues declining to multi-year lows. As the commission pool shrinks, banks lower headcount in equities, further reducing the quantity and quality of services provided to corporate issuers.

Repurposing the Institutional Equity Sales Model

Despite understanding the enormous importance of equity value, many public companies have entrusted investment banks to create interest in their shares. There have historically been no alternatives to this model. Companies that invested in their IR departments still relied on investment banks to broaden their marketing efforts. This model has been fundamentally disrupted as a result of significant regulatory and market forces. We have built Rose & Company in reaction to these market changes to proactively engage with new and existing shareholders exclusively as an advocate for our corporate clients.

Our approach has been embraced by both our clients as well as our friends on the buy-side, who appreciate being shown new investment opportunities and, equally importantly, that there is no implied cost. All we ask for is honest feedback and the opportunity to engage in an active dialogue on our clients’ behalf. It’s a very symbiotic relationship for all parties involved.

Providing feedback and engaging in active dialogue costs the portfolio manager nothing, but adds tremendous value for our clients. It shapes future messaging to proactively address key concerns, and it better enables us to prioritize future interactions and know who to call on our clients’ behalf as they execute on their strategies. We have found that being able to identify the next steps in the investment process is key to maximizing our clients’ time and resources. All too often, our clients lament that they are not sure whether time spent at a sell-side conference was time well spent. While we can’t force anyone to invest in a company, we can certainly help our clients understand their key concerns.

Our service is delivered with the same level of professionalism as an investment bank, but we work exclusively on behalf of our corporate clients, unconflicted by competing revenue streams. We work with our clients to evaluate, define, and execute investor outreach programs that result in building a high-quality shareholder base. Based on diverse perspectives ranging from capital markets to legal to marketing, we deliver high level market insight to help shape investor relations strategies and tactics. We then leverage a vast network of institutional investors, private wealth managers and research analysts to help to ensure that our clients are marketing their equity and debt stories effectively and to the right decision makers.

Working with companies to augment their investor relations efforts, we help to craft and amplify their stories to ensure they reach the right audience of like-minded investors. As an unconflicted advocate, we are able to engage with a large audience of potential investors on behalf of corporates to achieve successful outcomes. Our relationships with the buy side are based on an exchange of value – together we identify and engage with those corporates that could most benefit from the service we provide.